Binod Modi, Head Strategy, Reliance Securities

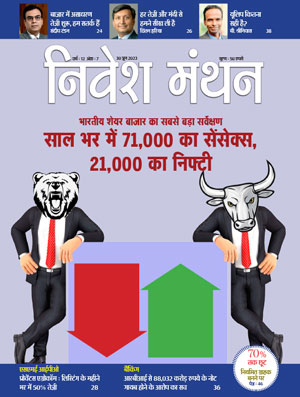

Domestic equities recovered sharply from early losses today mainly on positive global cues and sharp rebound in IT, PSU Banks and Pharma.

Stimulus bill in the USA continued to offer support to emerging markets including India. However, emerging risk pertaining to the new coronavirus strain made investors focus back on defensive sectors including IT, Pharma and FMCG. Notably, midcap and small cap stocks witnessed sharp rebound due to wider valuations gap compared to large cap peers.

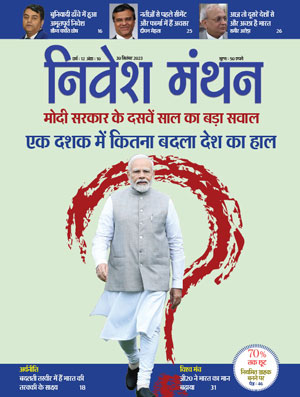

While new imposed economic restrictions in various countries and threat of new coronavirus strain to other nations weigh on investors’ sentiments, India still appears to be better placed given consistent reduction in new coronavirus cases and improvement in recovery rates. We believe domestic equities are likely to be volatile and trade in range bound in the near term and 3QFY21 corporate earnings are going to be crucial for the markets.

As we believe broad based rally looks difficult hereon given rich valuations and a number of threats for earnings recovery, investors must focus on quality stocks with strong corporate governance and margin of safety with strong earnings potential. (Share Manthan, December 23, 2020)

Add comment